internet tax freedom act us code

TITLE XIMORATORIUM ON CERTAIN TAXES SEC. Internal revenue codes related to indian tribal government.

What Can A President Do During A State Of Emergency The Atlantic

On July 1 sales taxes levied on internet access in six statesHawaii New Mexico Ohio South Dakota Texas and Wisconsinwill become illegal under the provisions of the Permanent Internet Tax Freedom Act PITFA.

. 105-277 imposed on state and local governments a three-year moratorium from October 1 1998 to October 1 2001 on 1 new taxes on Internet access and 2 multiple or discriminatory taxes on electronic commerce. The Internet Tax Freedom Act 47 USC. C title XI this act refers to only a portion of the Public Law.

Includes as negotiating objectives under such agreements. 108435 text PDF is the current US. 2020-1436 Internet Tax Freedom Acts prohibition against taxing internet access applies to all states beginning July 1 2020 On June 30 2020 the grandfathering provisions of the Internet Tax Freedom Act ITFA 1 which permitted states that taxed internet access before the ITFAs enactment to continue doing so will expire.

105-277 the Omnibus Appropriations Act of 1998 reproduced below establishes the Advisory Commission on Electronic Commerce. 2681 -719 47 USC. The Internet Tax Nondiscrimination Act PubL.

No inference of legislative construction shall be drawn from this subsection or the amendments to section 11055 made by the Internet Tax Freedom Act Amendments Act of 2007 Pub. We need our Executive Branch to lead a world-wide foreign policy initiative to keep the Internet a global tax-free zone. The new law amends the definition of Internet access to make clear that a product or service which is delivered by the Internet is not necessarily tax free.

It also established the Advisory Commission on Electronic Commerce. 110108 for any period prior to June 30 2008 with respect to any tax subject to the exceptions described in subparagraphs A and B of paragraph 2. The United States of America in Congress assembled SECTION 1.

Online sellers are still required to collect sales tax when selling items to buyers in states where you have sales tax nexus. C title XI Oct. This title may be cited as the Internet Tax Freedom Act.

The states would have collected nearly 1 billion in fiscal year 2021. The Internet Tax Freedom Act of 1998 ITFA. 105-277 imposed on state and local governments a three-year moratorium from October 1 1998 to October 1 2001 on 1 new.

This Act may be cited as the Internet Tax Freedom Act Amend-ments Act of 2007. C title XI Oct. On 1 st October 1998 the US government enacted the Internet Tax Freedom Act ITFA with the intent to further promote and develop the internet technology.

The tables below are for the entire Public Law Classification Authorizes. The permanent Internet Tax Freedom Act ITFA 47 USC. 151 note is amended 1 in section 1101a by striking 2007 and inserting 2014 and.

Internet Tax Freedom Act. 151 note preempts state and local. 1 to assure that electronic commerce is free from tariff and nontariff barriers burdensome and discriminatory regulation and discriminatory taxation.

21 1998 112 Stat. In the United States proposed new taxes by states local governments and special taxing districts also threaten the continued viability of the Internet. The Internet Tax Freedom Act and Federal Preemption Congress enacted the Internet Tax Freedom Act to establish a moratorium on the imposition of state and local taxes that would interfere with the free flow of interstate commerce over the internet.

Broadband Deployment is Extensive Throughout the United States but it is Difficult to Assess the Extent of Deployment Gaps in Rural Areas GAO-06-426 May 2006. The Internet Tax Freedom Act formerly known as S442 now Title XI of PL. Signed into law on December 3 2004 by George W.

Sections 40-21-80 and 40-21-100 Code of Alabama 1975 exempt Internet access charges from utility gross receipts tax and the utility service use tax as enacted by Alabama Act 98-654 in 1998. The telecommunications act of 1996 has the potential to change the way we work. The internet tax freedom act referred to in subsec.

And 2 to accelerate the growth of electronic commerce by expanding market access opportunities for the development of. 21 1998 112 Stat. Bush it extended until 2007 the then-current moratorium on.

The Internet Tax Freedom Act of 1998 ITFA. INTERNET TAX FREEDOM ACT THURSDAY JULY 17 1997. While the Internet Tax Freedom Act ITFA and its permanent counterpart PIFTA prevents states from imposing taxes on things like actually accessing the internet they do not have anything to do with eCommerce sales.

The ITFA put a bar on the states and the localities from imposing taxes on internet access. This law placed a moratorium on the special taxation on the internet. Internet Tax Freedom Act Pub.

Federal law that bans Internet taxes in the United States. The internet tax freedom act and isp tax moratorium since 1998 taxing internet access has been prohibited under the internet tax freedom act itfa.

Code Of Conduct And Other Policies Volvo Group

A Guide To Anti Misinformation Actions Around The World Poynter

Us Import Duty Custom Duty Calculator Freightos

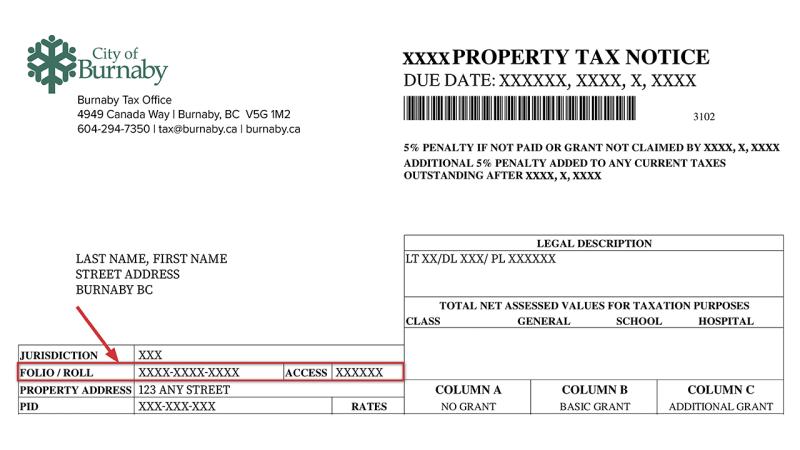

Cra T1135 Forms Toronto Tax Lawyer

People Are Talking About Web3 Is It The Internet Of The Future Or Just A Buzzword Npr

Question Of The Week Do I Have To Pay Tax On Us Stocks I Own In My Tfsa Nova Scotia Securities Commission

Netfile Access Code Nac 2022 Turbotax Canada Tips

/cdn.vox-cdn.com/uploads/chorus_asset/file/19763035/acastro_200302_3922_SuperTuesday_section230.2.0.jpg)

Section 230 Everything You Need To Know About The Law Protecting Internet Speech The Verge

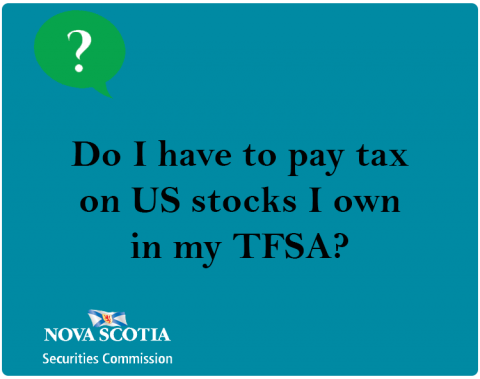

Privacy Law Reform A Pathway To Respecting Rights And Restoring Trust In Government And The Digital Economy Office Of The Privacy Commissioner Of Canada

Privacy Policy Template Free Website Example Termly

What S Wrong With Bill C 11 An Faq Openmedia

What Is The W 8ben E Form A Guide For Non Us Small Businesses

American Opportunity Tax Credit Aotc Definition

Privacy Policy Template Free Website Example Termly

Gst Hst Zero Rated Exempt Supplies Canadian Tax Lawyer S Guide

:max_bytes(150000):strip_icc()/history-gender-wage-gap-america-5074898_sketch-455ef27d4b304765ba4830023fed50bb.jpg)